Cybersecurity Alerts

FRAUD PREVENTION TIPS

Virginia National Bank (VNB) cares about the welfare of our clients and members of our communities, which is why we say, “It’s all about people . . . and always will be.”

The ongoing threat of cyberfraud and various scams continues to impact millions of people each day. As technologies evolve and new innovations are created, unfortunately, so does the advancement of cybercrime attempts through websites, emails, texts, and phone calls.

Our priority is to keep all VNB accounts and information secure as much as possible. Our cybersecurity team uses a variety of tools to safeguard your money with fraud monitoring, data encryption, and protection against suspicious activity.

BE PROACTIVE AND PROTECT YOUR ACCOUNTS

To strengthen defenses against fraud attempts, stay in control of your account, and keep a close watch on all Personal and Business bank accounts by using VNB’s Online Banking and Mobile App.

- Password protection for Online Banking

- Create strong, unique password phrases and store them in a secure password app or locked in a physical location.

- Use a mix of characters with uppercase and lowercase letters, numbers, and symbols.

- Enable multi-factor authentication (MFA) where available. This two-step verification process adds a crucial layer of security.

- Login Notifications

- Set up alerts for when an account is accessed online.

- Recognize when an account is accessed through a new device or browser.

- Transaction alerts

- Set up alerts to receive emails or text messages for transactions.

The sooner fraudulent activity can be identified, the quicker any necessary action can be done.

- Set up alerts to receive emails or text messages for transactions.

- Mobile App

- Additional security notifications and alerts keep your account safe while using VNB’s Mobile App.

Log into MOBILE APP using a strong password and Enable FaceID. Set up all VNB accounts with additional the Notifications & Alerts to strengthen security.

Always SIGN OUT of Online and Mobile Banking once the session is completed.

AVOID HOLIDAY SCAMS

Scams increase dramatically throughout the holiday shopping season. We are here to help our clients avoid fraudulent activity and theft as much as possible. Protect your accounts and learn how to identify the most common scams mentioned below.

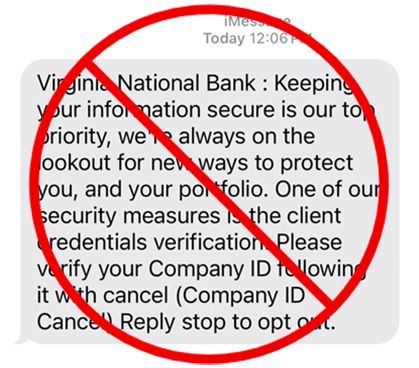

IMPOSTER SCAMS AND UNSOLICITED CONTACT

- Beware of unexpected calls, texts, or e-mails claiming to represent a financial institution, a government agency, or a charity.

- Often, these are attempts to steal your private information.

- These scams typically indicate that the matter is urgent, and action needs to be made quickly.

Example of a fraudulent text message sent to a VNB client.

- Fraudsters can initiate “Vishing” attempts, which mimic phone numbers and voices to trick unsuspecting people into revealing personal information.

- When in doubt, HANG UP. Call directly to verify request.

- Beware of suspicious links found in emails or text messages. Never click on suspicious links. Verify the message or request directly with the source found on the official website – not through the message received.

- Fake websites may trick you into installing info-stealing malware on your device.

- Some websites that are either not the real website or can be embedded in real websites that have been compromised, this tactic mimics the “Verify You Are Human” tests like CAPTCHA and tricks visitors into performing a series of keyboard entries.

- This results in an unwanted installation of malware designed to steal your personal information, usernames, and passwords from your device.

- Update software regularly and use your email spam filters.

- Perform regular anti-virus and malware scans on your devices.

- Always avoid pop ups online that claim to have a computer security breach. Pop ups are an easy way for fraudsters to gain access to your information.

- Check your accounts and credit report on a regular basis and look for unusual activity.

DIGITAL PAYMENT PLATFORMS (e.g., PayPal, Venmo, Zelle)

- Digital payment applications are an easy and quick way to send funds, but we encourage clients to be cautious.

- Only send funds to people you know and can verify their identity.

GIFT CARDS

- If you are asked by anyone to purchase gift cards, STOP. These scams are heavily used by fraudsters to use a contact you know to urgently request gift cards from major retail stores.

- Verify directly where the request is coming from.

- Criminals may tamper with gift cards for sale at retailers, sometimes replacing the number and PIN. When you purchase the gift card and load it with cash, the fraudsters would use those funds on the gift card immediately.

- Purchase gift cards from behind the counter, when possible. Also make sure the wrapping hasn’t been tampered with.

BUYING AND SELLING GOODS ONLINE

- If a deal is too good to be true, it may be fraud. Do your due diligence before purchasing or sending a digital payment. Always know who you are buying from or selling to.

AVOID MAILING CHECKS, WHEN POSSIBLE

The largest and most increasing methods of financial fraud are mail-theft check fraud. Criminals steal mail, look for checks, then sell these checks to others – sometimes on the dark web.

Avoid being a victim of check fraud by reviewing checks that are clearing your account on a daily basis with online banking.

- Review financial statements regularly.

- Stay vigilant for checks that have been written and not negotiated.

Other tips to prevent mail theft and check fraud:

- Pay digitally when possible.

- Use VNB’s Bill Pay service through Online Banking. Using this service means the payment information will be printed onto a check, with makes it more difficult to modify information compared to a hand-written check.

- If you must hand-write a check,

- Consider using a black gel pen. This ink is more difficult to remove.

- Use mailboxes that are secure if sending through the mail. Consider using a mailbox inside a USPS facility rather than a curbside mailbox or residential outgoing mailbox.

TREASURY MANAGEMENT SERVICES

BUSINESS ACCOUNT SAFETY

- Contact our Treasury Management department to set up check and ACH Positive Pay help reduce fraud.

- Pay only the checks and transactions that you approve.

- Decrease the risk of loss to your business account by catching fraudulent checks before they settle.

MAKE SURE IT'S REALLY US

Fraudsters may pose as representatives of Virginia National Bank. Report unusual calls, texts, emails, and links to us at 877.817.8621.

Virginia National Bank will NEVER ask our clients to provide your:

- Personal Identification Number (PIN) or security codes

- Bank account information

- Personal information once your account is opened

We will NEVER ask you to send payments anywhere.

Do you think you might be a victim of fraud?

If you are concerned with potential fraud, please reach out to our Client Care Center at 877.817.8621 or contact us here.